A case for tech in Civil Aviation

Source : Marquee Workforce Solutions

9 dollars. That’s as much profit as an average airline made on each passenger it flew in 20171. In a slightly different context, that’s a net margin of about 4.7% which is a little better than the benefits that the credit card company gave back to you2 on the sandwich you bought at the airport. Of course, this back-of-sandwich-bill analysis assumes your credit card didn’t get you complementary lounge access in which case the question of buying sandwiches and related cashbacks is moot.

Multiple ideas stand out then :

1. If you must start a business, start a credit card company rather than an airline. Or a sandwich company.

2. Civil Aviation could use a strong infusion of technology to help bolster its bottom-line, which is what this article is about, not sandwiches or credit cards.

There’s another way to look at the problem. How would you use the financial statements of an aviation company to drive an R&D strategy?

A good place to start : Profit and Loss Statements

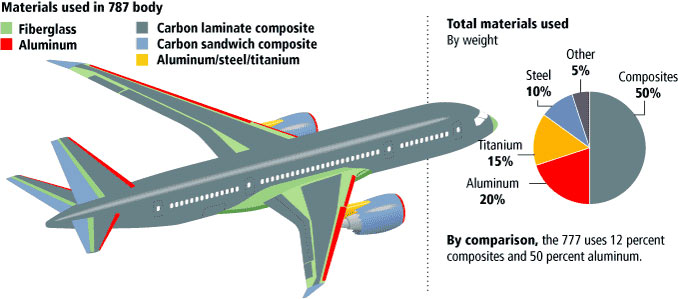

The revenue and costs for the civil aviation sector can be looked at separately since the drivers for each are largely distinct and yield different technical solutions as elaborated below.

Cost drivers

Lumpy capacity and Traffic Analytics

Source : The Weather Company

The most noteworthy aspect of the problem is the lumpiness of the airline’s capacity and costs, which is to say, the airline incurs costs at the aircraft level but it earns money at the passenger level. The only way to balance this equation is to ensure that the costs and revenues are on the same level, i.e., the plane runs at full capacity as far as possible. For you and me this means that cancellations and rescheduling of budget airline flights at non-peak hours are here to stay.

How does an airline go about deciding what times are peak hours, what kind of traffic is a certain sector likely to see, what are airport wait times likely to look like in these hours and how much additional fuel is it going to take to cover for this waiting time, what aircraft need to be deployed and which pilots have the necessary type ratings and may be assigned duties?

Analytics allows the airline to make sense of mountains of past data and pick the right schedule, assign the right aircraft and pilot, and carry the right amount of fuel to ensure the highest possible utilization of capacity at the lowest possible cost.

Source : Aviation Stack Exchange

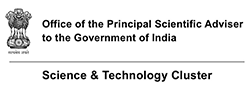

20% of airlines’ costs are accounted for by fuel costs. When broken down into the simplest parts, the fuel costs can be traced back to the weight of the whole aircraft.

The maximum take-off weight of the typical single-aisle aircraft (Airbus A320 / Boeing 737) is around 75tons3. The total weight of passengers and their luggage is about 15.6 tons (180pax weighing 70kg body weight and carrying 10kg check-in luggage and 7kg carry-on luggage)). What this means is that a minimum of 75-80% of the all-up weight does not pay for itself!

The obvious question then, how does one bring this down? How much weight could the manufacturer save by shifting to lighter materials? Composites? Carbon-fiber? The problem is that lighter materials generally present themselves in the form of a double-edged sword. The ability of lighter new-age materials to replace conventional materials is a direct consequence of the increased hardness and strength of these materials. This makes them less machinable giving rise to new cost-drivers: what kind of process and tooling changes would be needed to machine these materials? Would this also require part design changes which would need re-certification?

Since the costs of the new machining equipment as well as the redesigns and recertifications would be borne by the OEM and amortized across all new planes manufactured, how would this affect the cost of acquisition for an airline. Secondly, since a large number of aircraft these days are procured on leases rather than outright purchases4, how does this new technology affect Maintenance and Repair Operations (MRO) processes and timelines? Also, how does this affect the supply chains for original and spare parts and what are the associated costs?

Additive manufacturing

Source : EuroNews

No discussion on material technology and manufacturing is complete without touching upon additive manufacturing or 3-D printing. While 3-D printing has the potential to bring down total cost of ownership for small volume or niche jobs, especially prototyping, the impact on the civil aviation sector will need to be evaluated carefully.

This is because on a small run, additive manufacturing does away with a lot of the infrastructure requirement (specialized equipment). On an intermediate volume run, the costs are comparable but 3-D printing edges ahead as it simplifies the supply chain5. On a larger volume run, traditional manufacturing with an established supply chain is significantly cheaper. Of course, the tipping point at which one method becomes more or less expensive than the other can be expected to be a strong function of the complexity of the design itself, making it hard to pass a sweeping judgement.

In the longer run, however, when it comes to complete redesigns of components or the aircraft itself, the ability of 3-D printing to manufacture very complex shapes without running into issues of tool fouling and mold removal like in traditional manufacturing makes significant weight reduction at a component and assembly level possible. Also, as the capability of 3-D printers to work with metals improves, the utility of the technology can be expected to explode!

In general, though, 3-D printing is likely to make a much larger or atleast earlier mark in the Defence Aviation sector where volumes are much lower than civil aviation and manufacturer support is often low or unavailable due to various reasons including shifts in strategic concerns.

Ground costs and IoT

Source : Vienna International Airport

Source : GE Aviation

Ground costs are another form of lumpy variable costs that apply at the aircraft level. These include a host of charges starting from the usage of airspace, the apron and towing charges, the overnight parking charges, etc. The other way of looking at it is that since passengers pay for a trip and not for the time, the airline’s worry over economies of density is now twofold – people as well as time, i.e., the airline needs to cram in more people per flight and more flights per day. In other words, any aircraft not in the air is actually bleeding money.

The typical nature of ground costs is a step-function wherein the first chunk of time at the airport (typically the first two hours) is free, followed by a time-proportional charge6 for additional hours. Connected aircraft, or aircraft with a host of sensors attached to various key components relaying data back to a central analysis unit, help to relay information about aircraft health, predict how much additional scrutiny it is going to need (beyond the standard scheduled checks) and how much time this is likely to take. When extended to ground equipment such as carts and ladder-trucks which are often owned and operated not by the airline but by a third-party service

provider (and are hence less controllable), the airline is now able to have a stronger grip on the people and material flow on ground and is better able to predict how long the aircraft will be on ground.

Training costs and Augmented/ Virtual/ Mixed Reality

Source : NLR Netherlands Aerospace Centre

Augmented/ Virtual/ Mixed Reality (AR/ VR/ MR) hold some potential to drop training costs for MRO operations since physical equipment is no longer needed to train incoming engineers. However, this claim will need to be investigated carefully for the following reasons :

1. AR/ VR/ MR solutions which replace standard VR devices such as the HoloLens with regular tablets or other mobile phones for reasons of lower cost and greater comfort do not seem to add significantly greater value over, say, viewing a 3-D CAD model of the component on a computer. While the cost of a (additional) software license would be saved, this cost when spread over the thousands of engineers trained is no longer very significant.

2. From the MRO perspective, at the current state of the art, AR/ VR/ MR solutions do not automate but will only digitize and document the scheduled checks of the aircraft since the list of checks to be performed is mandated by the regulatory authority, is non-dynamic and is inviolate. Hence an MR solution could tell an engineer that a certain bolt is to be tightened to 100 Nm but would not be able to tell the engineer that the bolt appears to be broken and needs replacement.

Where AR/ VR/ MR solutions score in the current context is on two counts. In the training space, AR/ VR/ MR solutions address a serious shortage in skilled manpower by handholding MRO trainee engineers directly on the job by making instructions available in a visual fashion inline with or overlaid on the actual component being inspected. It also smoothens the workflow for the engineer by reducing the need to keep switching between the component and manual while on the job, improving efficiency by about 10-12%

In the long run, AR/ VR/ MR could disrupt the training and the MRO domains with the addition of two pieces of critical technology which are being researched at the time of writing this – haptic feedback and visual feedback, respectively. In the training area, if the integration of haptics allows engineers to get a feel (literally!) for the components that they are likely to work on, the benefits over traditional 3-D CAD models, etc. could be significant.

Similarly, in the MRO space, if the AR/MR solution is able to compare or overlay the actual component with an ideal component and is able to highlight the differences, the process of fault localization could be greatly speeded up leading to much larger benefits than just efficiency improvements.

Revenue drivers

Source : Fandom : The Star Wars Wikia

To the outsider building solutions for the airline industry, it is unfortunately quite common to incorrectly identify the revenue drivers because of directly carrying over insights from other industries which target the same segment of consumers.

For example, the buyer of a luxury sedan is also likely to travel by air more frequently than some others but that does not mean that the buyer perceives these two products / services identically. Air-fares over the last few decades have dropped continuously and air travel for the population at large (barring the charter flight and private plane users) has increasingly been commoditized. Thus, unlike the sedan which is often an emotional purchase with the buyer paying not only for the asset but also for what the asset represents, the aircraft ticket is in principle identical to buying a seat on a ride-sharing cab service and the purchase considerations are likely to be similar, with a focus on service levels, punctuality and reliability rather than brand value or luxury or creature comforts.

This brings us back to the question of traffic analytics and economies of density of space. True differentiation between competitors on typical short haul flights taken by business passengers that is monetizable is more likely to come from predictable on-time arrivals and departures with fewer cancellations, faster check-in and baggage retrieval, etc. rather than bigger boxes of salted peanuts, hotter meals or softer seat cushions.

Summary

The above discussion can be summarized as follows :

Conclusions

Historically, technology has been the most disruptive force in industry, starting from the industrial revolution (Industry 1.0) two hundred and fifty years ago7 to industry 2.0 a century ago, and industry 3.0 and 4.0 in the last quarter century, with the pace of transformation constantly accelerating.

Responding to the ever-quickening rate of transformation brings us to one of the cornerstones of management strategy – specialization of functions within an organization. This necessitates the offloading of a large part of the research to universities while industries focus on implementation or execution and value maximization. This is reflected in the shrinking of integrated industrial research powerhouses such as AT&T-Bell Labs8, the dismantling of General Motors’ India Science Lab9, and in the ongoing restructuring of industrial behemoth GE10.

The process of specialization of functions within organizations also creates the need for a network player or moderator such as the Research and Innovation Circle of Hyderabad (RICH), which specializes in addressing the information asymmetry between industry and academia, streamlining information transfer between the two, thereby building a sustainable ecosystem in which each party plays to its strengths instead of diversifying on behalf of the other, jointly serving to maximize value to the end-user, unbeknownst to her, as she buys her sandwich.

References

1 http://www.iata.org/pressroom/pr/Pages/2017-12-05-01.aspx

2 https://www.nerdwallet.com/blog/credit-card-rewards-study/

3 http://www.flugzeuginfo.net/acdata_php/acdata_a320_en.php

4 https://www.iata.org/whatwedo/workgroups/Documents/ACC-2016-GVA/ACC2016_Alex_PHILIP.pdf

5 “The future of spare parts is 3D : A look at the challenges and opportunities of 3D printing”, Strategy&, 2017

6 https://www.aai.aero/en/services/airport-charges

7 https://www.essentracomponents.com/en-gb/news/infographics/industry-1

8 http://ethw.org/Bell_Labs

9 https://www.thehindubusinessline.com/companies/GM-offers-new-roles-to-90-staff-of-%E2%80%98India-Science-Lab/article20428934.ece

10 https://www.cnbc.com/2017/11/13/ge-announces-broad-restructuring-to-keep-health-care-aviation-and-energy- units.html ; https://www.ge.com/investor-relations/sites/default/files/GE%20Investor%20Update_Presentation_11132017.pdf